Spotlight on the BFC Accounting and Finance Department

In the fast-paced world of business, each team plays a unique role in driving the organization forward. Behind every strategic decision, new project, and expansion plan stands a team dedicated to safeguarding the company’s financial health—that team is our Finance Department. As the silent backbone of the organization, these skilled professionals ensure fiscal stability and provide the essential support needed to achieve our ambitious goals.

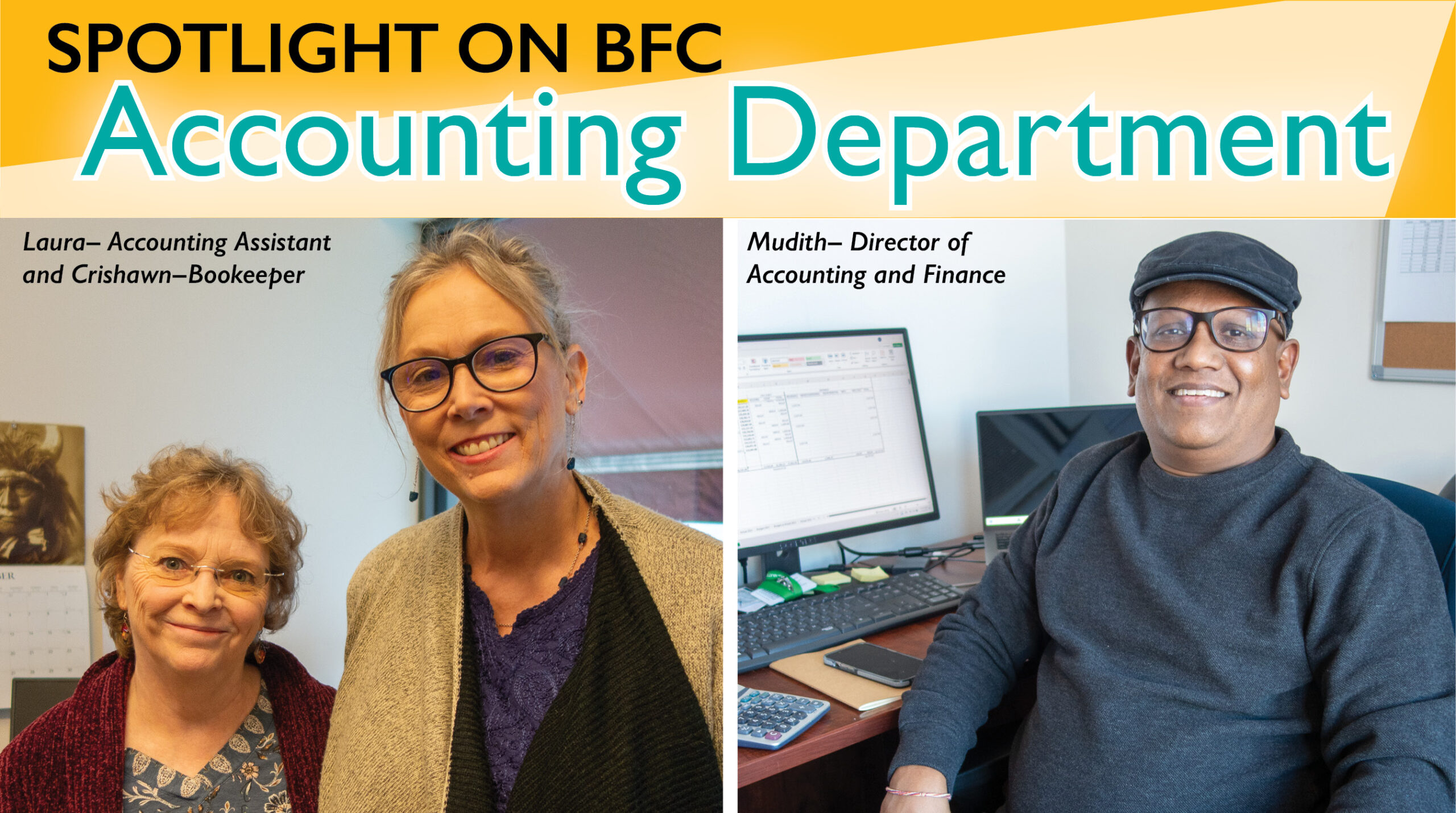

The BFC Accounting & Finance Team

As a key member of our Finance team, Crishawn plays a vital role in ensuring the smooth operation of our financial processes. With 20+ years of experience in accounting and finance, she has developed a keen eye for detail, a passion for streamlining processes and ensuring compliance with financial regulations, and brings a wealth of knowledge and expertise to the department. Her dedication to building strong vendor relationships and managing timely payments reflects her exceptional organizational and interpersonal skills, which are vital to our department’s success. With a commitment to both professional growth and teamwork, she looks forward to continuing to contribute to the Finance department’s success. Her love for outdoor activities like kayaking, camping, and hiking also highlights her balanced approach to life—finding time to recharge while staying dedicated to her professional responsibilities.

Laura joined The Brattleboro Food Co-op in 2023 as an Accounting Assistant, bringing a keen eye for detail and dedication to accuracy in financial processes. With a focus on supporting the Co-op’s mission through diligent financial management, Laura contributes to our Co-op’s efficiency and transparency. Most importantly, she manages shareholder loans, building strong connections with shareholders. This enables the Co-op to maintain a reliable flow of capital and foster trust and collaboration with shareholders. Her focus on cultivating these relationships ensures we have solid financial support for both daily operations and long-term growth initiatives. Outside of work, she enjoys hiking with her dog and traveling, bringing harmony and inspiration to her role at the Co-op.

I’m Mudith, the Director of Accounting & Finance. I joined the BFC in April of 2024, bringing over fifteen years of experience in accounting. Throughout my career, I’ve had the opportunity to work across nearly every facet of accounting, developing a deep expertise in key areas such as strategic financial planning, financial analysis, risk management, budgeting, and cost control. In addition to these core competencies, I’m passionate about leveraging technology and process improvements to streamline operations and enhance financial accuracy. At the BFC, my goal is to contribute to the company’s financial resilience and provide recommendations that will strategically position us for sustainable, long-term growth.

What does the Accounting & Finance department do?

The finance department is often considered the backbone of any successful organization, playing a vital role in managing resources, supporting strategic decisions, and ensuring financial stability. This department is responsible for a wide range of functions that touch nearly every area of the business, from day-to-day operations like accounts payable and receivable to high-level tasks such as budgeting, financial planning, and risk management. By managing these critical functions, the finance department not only safeguards the company’s financial health but also contributes significantly to its long-term success.

One of the primary functions of the finance department is financial planning and budgeting. This process involves setting budgets for various departments, forecasting revenue, and planning for future expenses based on historical data and projected growth. By accurately budgeting and forecasting, the finance department ensures that the organization has the resources needed to meet its operational goals without overextending itself. This planning also provides a roadmap for each department, creating financial boundaries that help control spending and keep the organization on a sustainable growth path.

Financial reporting is another core responsibility of the finance department. This includes preparing financial statements, such as income statements, balance sheets, and cash flow statements, which provide insights into the company’s overall performance. These reports are not only essential for internal stakeholders, who use them to make informed decisions, but they are also required by external stakeholders, such as investors, regulatory bodies, and creditors. Through clear and accurate reporting, the finance department helps establish transparency and build trust with stakeholders, reinforcing the company’s reputation.

On a daily level, the finance department is responsible for the accounts payable and receivable processes. Accounts payable ensure that the organization meets its financial obligations to suppliers and vendors in a timely manner, fostering strong business relationships and avoiding penalties. On the other hand, accounts receivable focus on collecting payments from customers, ensuring a steady inflow of cash. This balance of cash inflows and outflows is crucial for maintaining a healthy cash flow, which is essential for meeting day-to-day expenses and ensuring the organization’s operational continuity. Compliance and tax management are other critical areas handled by the finance department. In a complex regulatory landscape, it is essential for companies to comply with financial regulations and tax obligations. The finance team ensures that the organization meets all legal requirements, files accurate tax returns, and keeps up with changing tax laws. By doing so, the finance department helps the organization avoid costly fines and penalties, while also looking for opportunities to optimize tax liabilities, thereby enhancing profitability.

In today’s fast-evolving social, economic, and technological landscape, the finance department plays a pivotal role in ensuring the Co-op’s financial stability and driving future growth. Through the implementation of strong policies and processes, alongside the integration of new technologies, the team effectively navigates uncertainties and positions the Co-op for long-term success.

By Mudith Kalutota

About Producer of The Month

Shop Online

On Sale Now!